Forex trading, also known as foreign exchange trading or currency trading, is the international marketplace for getting and selling currencies. It operates twenty four hours a day, five times weekly, letting traders to participate on the market from everywhere in the world. The primary purpose of forex trading is to benefit from fluctuations in currency change costs by speculating on whether a currency couple will increase or drop in value. Players in the forex market contain banks, financial institutions, corporations, governments, and specific traders.

One of the critical options that come with forex trading is their high liquidity, and therefore big volumes of currency are available and sold without considerably affecting change rates. This liquidity assures that traders may enter and quit roles quickly, enabling them to make the most of also little value movements. Furthermore, the forex market is highly accessible, with low barriers to entry, letting individuals to start trading with somewhat little levels of capital.

Forex trading provides a wide variety of currency sets to deal, including important couples such as EUR/USD, GBP/USD, and USD/JPY, as well as small and exotic pairs. Each currency couple presents the change rate between two currencies, with the initial currency in the pair being the base currency and the second currency being the offer currency. Traders may benefit from both growing and falling markets by taking extended (buy) or small (sell) jobs on currency pairs.

Successful forex trading needs a stable understanding of fundamental and complex analysis. Elementary analysis involves assessing economic signals, such as for instance fascination charges, inflation charges, and GDP growth, to measure the main energy of a country’s economy and its currency. Complex analysis, on one other give, requires considering price charts and styles to recognize trends and possible trading opportunities.

Chance administration can be crucial in forex trading to safeguard against possible losses. Traders frequently use stop-loss instructions to restrict their drawback risk and utilize appropriate position dimension to make sure that not one deal can significantly impact their overall trading capital. Moreover, maintaining a disciplined trading approach and handling feelings such as for instance greed and fear are essential for long-term achievement in forex trading.

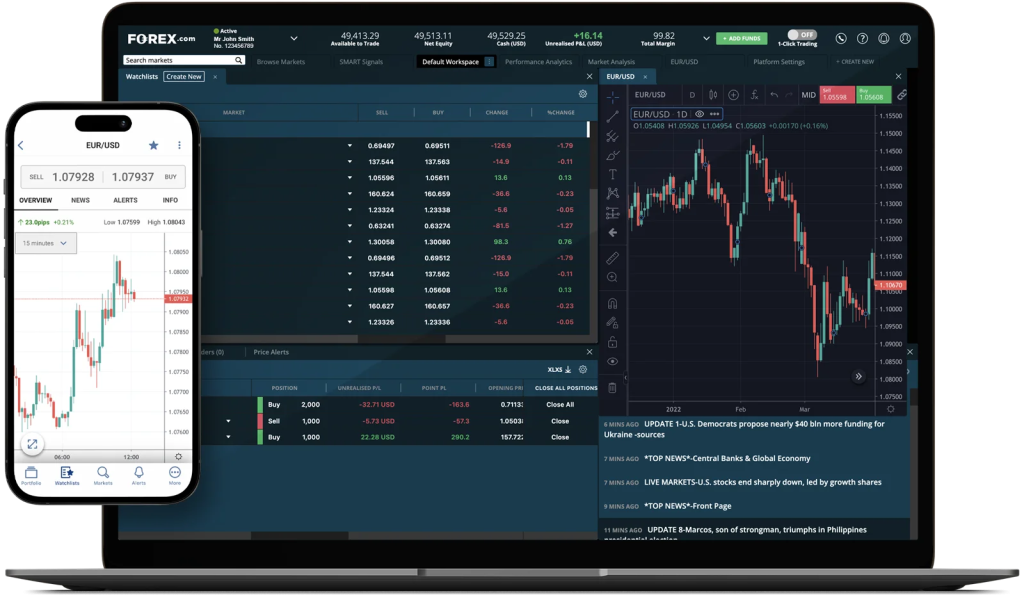

With the growth of engineering, forex trading has be accessible than ever before. On line trading tools and mobile programs give traders with real-time usage of the forex industry, letting them accomplish trades, analyze industry data, and handle their portfolios from any device. Moreover, the availability of academic forex robot sources, including lessons, webinars, and demo records, empowers traders to produce their abilities and boost their trading efficiency around time.

While forex trading offers substantial income possible, in addition it bears inherent dangers, like the prospect of significant losses. Thus, it is essential for traders to conduct complete research, create a sound trading technique, and continually monitor industry problems to produce informed trading decisions. By staying with disciplined risk management techniques and staying knowledgeable about worldwide financial developments, traders may improve their likelihood of success in the vibrant and ever-evolving forex market.